By Mediawire

Jan 14, 2021, 14:25 IST

Throughout its 30-year history, the EB-5 Visa Programme has proven to be successful in attracting billions of dollars in foreign investments to the United States (US). With a minimum investment of $900,000 USD, the EB-5 Programme appeals to high net-worth individuals aiming to obtain a second passport and settle in the US. This trend has many families around the globe planning for their futures.

While historically the EB-5 Programme has been extremely popular among Chinese investors, industry experts are calling attention to a new locale with a growing number of investors: India. Still considered a top destination for Indians to receive higher education secure successful careers, the US has seen an increase in the number of Indian EB-5 applicants, from 350investors applied in 2016 to almost 1,000 in 2019.

The Changing EB-5 Landscape

This increased demand among Indian investors signifies a change in the EB-5 landscape. In FY 2020, India accounted for 17% of the total EB-5 visas issued world-wide, an increase of nine percent from the previous year.

“This is a significant shift in the ever-changing EB-5 landscape” said Mark Davies, Esq., Global Managing Partner and Founder, Davis & Associates, LLC. “Indian investors are looking to provide financial flexibility for their families, and secure opportunities abroad. The EB-5 Programme grants these applicants the opportunity to invest in the US, create jobs and secure a second passport. While the political landscape continues to change, the EB-5 Programme provides international families with options.”

In fact, the visa programme was so popular that the wait times for Indian applicants increased dramatically and resulted in a long backlog two years ago.

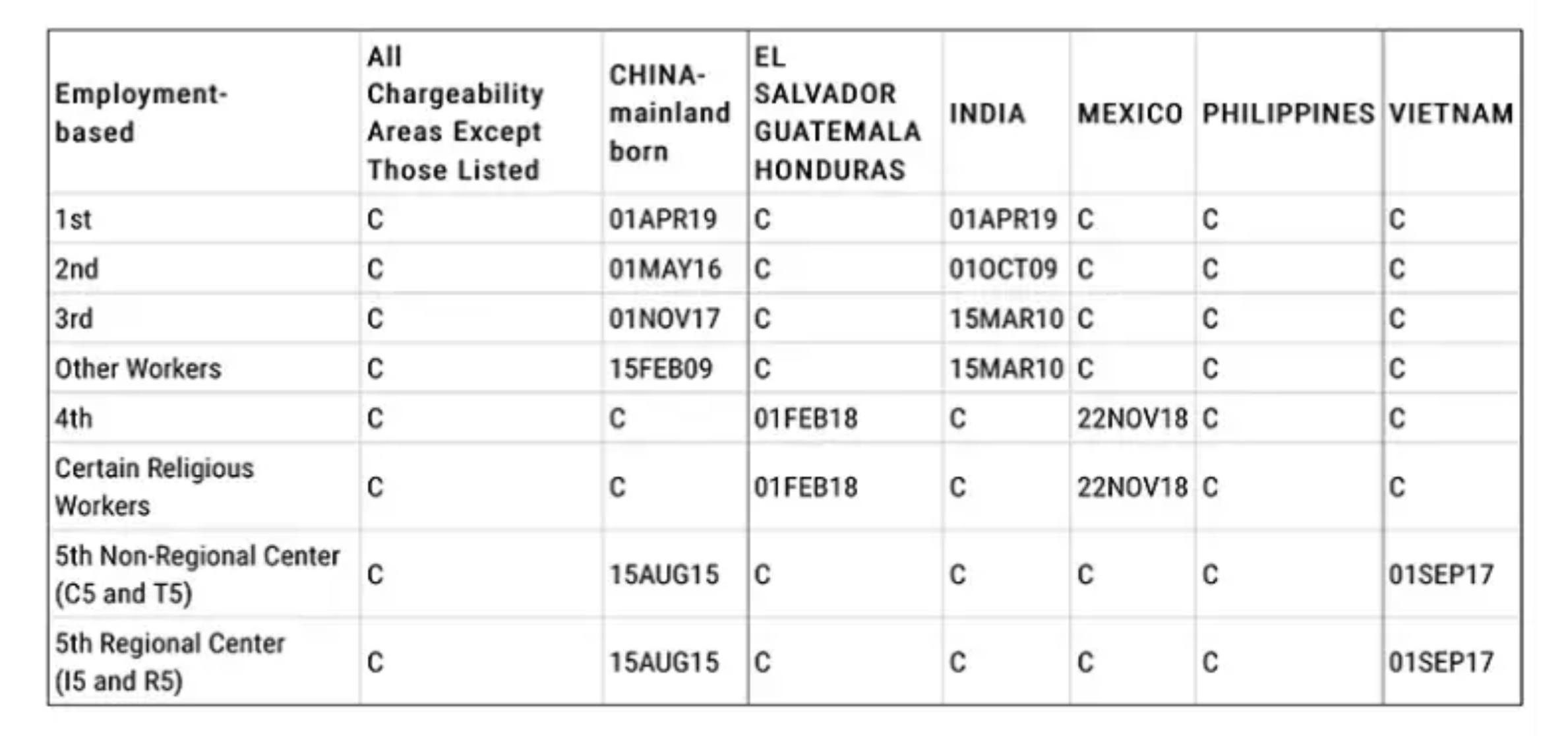

Recently, due to price adjustments and greater visa availability, the wait time has decreased. Per the US Citizenship and Immigration Services (USCIS) Visa Bulletin from December 2020, there is currently no backlog and no extra wait-time projected for EB-5 applications from India. Additionally, according to a statement by Charles Oppenheim, Chief of the Visa Control and Reporting Division, U.S. Department of State, there will be more visa availability and shorter wait times in FY 2021.

Per the US Citizenship and Immigration Services (USCIS) Visa Bulletin from December 2020, there is currently no backlog and no extra wait-time projected for EB-5 applications from India.

Industry experts note that those looking to apply for the EB-5 Visa should consider the potential benefits from a tax planning perspective and act before Q2 2021. With the end of the fiscal year quickly approaching, Indian investors should be aware of the RBI Rules on money transfer abroad limits which restrict the abroad transfer funds to $250,000 USD per year. Interested applicants could transfer part of the funds in Q1 and the remaining capital in April to meet both RBI rules and EB-5 Programme requirements.

The Benefits of an EB-5 Visa

Administered by the US Citizenship and Immigration Services (USCIS), the EB-5 Programme is an investment tool designed to diversify global investment portfolios and has been recognized as a way to potentially increase personal and economic freedom and lead to a tax-optimized life. The benefits of obtaining permanent green cards through this programme have Indian Families planning for their futures.

“For the families that are able to obtain and invest the minimum amount, the potential benefits are quite substantial,” said Jeff DeCicco, Chief Executive Officer, CanAm Investor Services, a FINRA-registered Broker-Dealer. “Green cards may be granted for the qualifying applicant, his or her spouse, and unmarried children under the age of 21. For families looking to educate their children in the US, there are even admission advantages and reduced tuition costs available.”

The EB-5 Visa Programme grants investors the opportunity to live and work anywhere in the US and allows investors to return to their country of origin for personal or business purposes if they maintain US residency. For those looking for a path to US citizenship, the two-year conditional permanent residency (i.e., green card) is credited towards the five-year lawful permanent residency requirement. Investors may apply for US citizenship after this five-year period.

With three decades of experience promoting immigration-linked investments in the United States and Canada, CanAm has a long and established track record. Basing its business on a reputation of credibility and trust, CanAm has financed over 60 projects and raised $3 billion in EB-5 investments. More than $1.75 billion in EB-5 capital from over 3,500 families has been repaid by CanAm to date. CanAm exclusively operates seven USCIS-designated regional centers that are located in the city of Philadelphia, the Commonwealth of Pennsylvania, the metropolitan regions of New York & New Jersey, the states of California, Hawaii, Florida, and Texas. For more information, please visit www.canamenterprises.com.