Building a nest egg to help finance a college education for children or grandchildren is a top goal for many families. That can be a challenging task with higher education costs that seem to climb higher year after year. Industry research shows that college tuition and fees have risen 25% over the past 10 years, and many colleges and universities have continued to raise tuition and fees even during the pandemic. The fundamental question for families is how much savings is enough?

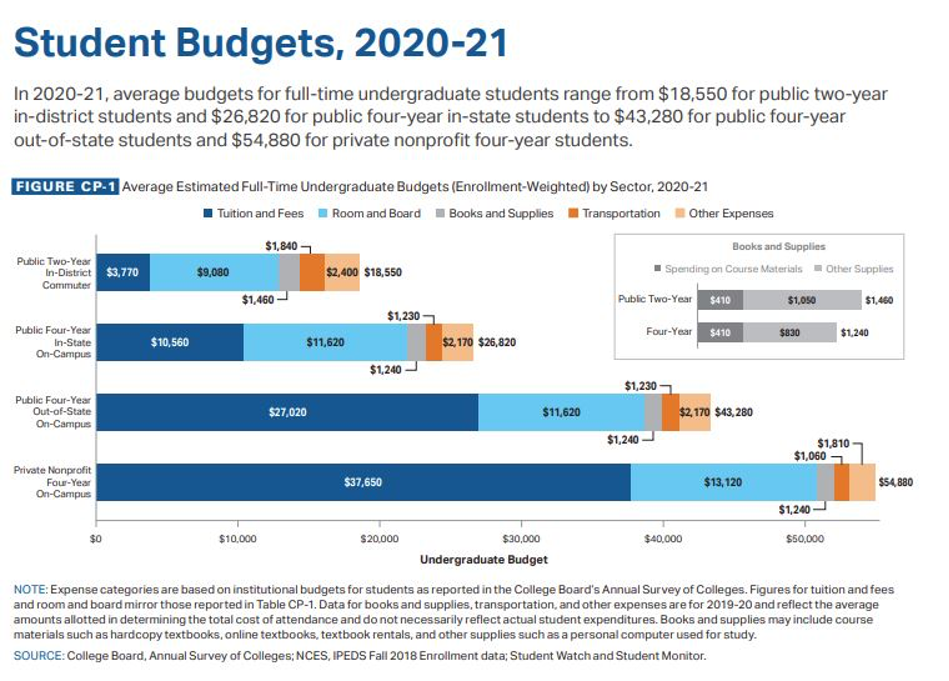

Costs vary widely depending on the institution. A current snapshot for the 2020-21 school year provides a starting point for families. Ivy League schools command a premium, with the average tuition bill for undergraduates at the likes of Harvard, Columbia and Brown coming in at more than $56,000 per year. Adding on student fees, room & board pushes annual costs above $75,000 at many of the elite schools. According to the College Board, the averaged published (sticker price) for tuition and fees for full-time students in 2020-21 are:

- Public four-year in-state: $10,560

- Public four-year out-of-state: $27,020

- Private nonprofit four-year: $37,650

Tips for saving

Families can find online tools such the College Savings Calculator help to estimate future costs. Some experts predict that the estimated cost of putting a newborn through public college 18 years from now is nearly equivalent to buying a median-priced home. Saving that much for one child, let alone multiple children, can seem overwhelming. However, a few simple steps can help put you on the path to success.

1. Start to save early. The earlier you start saving, the more time you have for your savings to grow. According to a recent New York Times article, if you start investing when your child is a newborn, roughly one-third of the savings will be generated from the earnings on your investments. If you wait until high school, less than 10% will come from earnings.

2. Develop a realistic goal. Do you want to pay for all or part of a child’s college tuition? You may decide to pay for half or contribute a set dollar amount, such as $100,000, or simply contribute a to-be-determined amount within your means to help your child pay for their college expenses.

3. Consider a dedicated education plan such as a 529 Plan or a UTMA/UGMA account.

- In a 529 Plan, you set up an account and choose how to invest the money. Contributions are made with money that has already been taxed, and the money grows tax-free. Money that is withdrawn is also free of income and capital gains taxes as long as it is used to pay for qualified higher education expenses (some states also allow the money to be used for K-12 tuition). Some key points to understand a 529 Plan include:

– Withdrawals spent on qualified higher education expenses and up to $10,000 per year in K-12 tuition avoid federal tax, and some states offer additional state tax benefits.

– Some 529 Plans will give you the option to change the beneficiary to another family member. So, if one child decides not to attend college, or does not use all of the funds in the account, you may be able to use those savings for another child.

– Earnings are subject to income tax and a 10% penalty if the withdrawal is not spent on qualified education expenses.

– These are state-based plans and rules can vary depending on the individual state. So, it is important to look at options and know what the rules are for a particular plan before you commit.

- UTMA/UGMA accounts can be created in the child’s name but are controlled by a named custodian for the minor account holder, such as a parent or grandparent. The custodian can manage the investment account, which may invest in stocks, bonds and other investments on behalf of the minor until the child reaches an age where they are permitted to take control (18 for the UGMA and 21 for the UTMA). One difference compared to a 529 Plan is that funds in an UTMA/UGMA account do not have to be used solely for educational purposes. Some key points to understand about UTMA/UGMA accounts include:

– Contributions to this type of account are considered to be irrevocable gifts to the minor.

– There are no immediate tax benefits as contributions are not tax deductible. In addition, for every child younger than 19 (or 24 for full-time students) who is included as a dependent on their parents’ tax return, the unearned income from that account is taxed at the parents’ rate once it gets above a certain amount ($2,200 for 2020).

– Both 529 Plans and UTMA/UGMA accounts require the account holder/custodian or provide a social security number or individual taxpayer identification number for the beneficiary (child) when opening an account.

4. Be mindful of risk.Investment strategies should take into account the time remaining before a child enters college and needs to access funds. The strategy you have when the child is 5 years old will likely be different than when that child is 15 or 16. Some 529 Plans are set up to automatically shift to more conservative strategies as a child gets closer to entering college, such as higher allocations to cash and fixed-income assets in order to preserve principal and reduce exposure to market volatility.

5. Look for scholarships. There are numerous scholarship opportunities available from a wide variety of sources, including many that are not “needs based”. Scholarships span a variety of areas beyond academics and athletics to include special interests and groups such as music, robotics, volunteerism and community involvement. Students often apply for scholarships as incoming freshman, but they also can find new scholarship opportunities as undergrad and graduate students throughout their time at college.

We understand that the planning for a child’s future is one of every parent’s top priorities. CanAm is preparing to host a series of Webinar on related topics. If you have any questions or suggestions, please contact us at Marketing@canamenterprises.com

As with any investment and financial planning strategy, it is always wise for investors to conduct careful due diligence and work with a trusted advisor.

With three decades of experience promoting immigration-linked investments in the United States and Canada, CanAm has a long and established track record. Basing its business on a reputation of credibility and trust, CanAm has financed over 60 projects and raised $3 billion in EB-5 investments. More than $1.75 billion in EB-5 capital from over 3,500 families has been repaid by CanAm to date. CanAm exclusively operates seven USCIS-designated regional centers that are located in the city of Philadelphia, the Commonwealth of Pennsylvania, the metropolitan regions of New York & New Jersey, the states of California, Hawaii, Florida, and Texas. For more information, please visit www.canamenterprises.com.